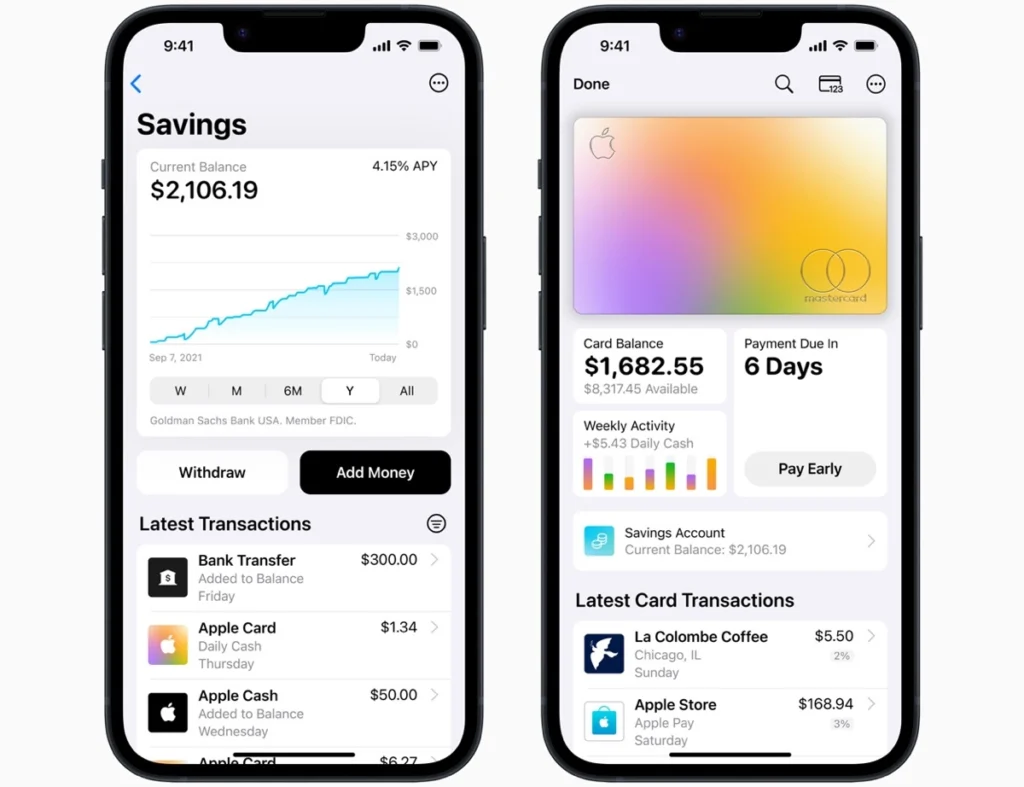

Apple’s financial services undergo an important acceleration in the United States where the Apple Card Savings Account was introduced, in fact the first savings account of the Cupertino multinational which makes its debut in the sector with the support of Goldman Sachs, but above all surprising users and the market with an unusually high interest rate: as much as 4.15%, about 10 times higher than the US average.

Gurman reveals all the news that will be presented by Apple at WWDC 2023

US Apple Card users can activate their savings account with a tap in Wallet on iPhone. The interest rate provided by Apple is applied to refunds calculated as a percentage of purchases paid for with Apple Card at partner companies and shops.

For example, in the USA you get a 3% refund on all purchases of Apple products if you pay with Apple Card, 2% if you pay with Apple Pay instead, 1% for other purchases. You also get 3% cashback on purchases at other stores and companies including Exxon, Nike, T-Mobile, Uber Eats, Uber, Walgreens and more.

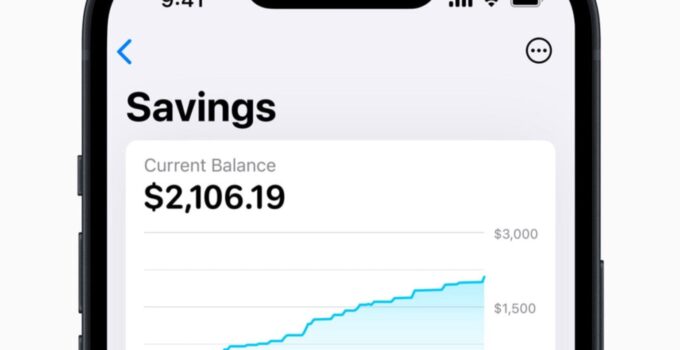

In addition to depositing refunds into your Apple Card Savings Account, the Apple Card user can take greater advantage of the high interest rate Apple pays by depositing other savings into the account as well. The dedicated Saving Account button is visible in the Apple Card interface in the USA. With a tap, the list of transactions and a graph showing the growth of the deposit are displayed.

There are no commissions, no minimum deposits, and no minimum balance requirements either. At any time, the user can decide whether to continue paying the repayments into the high-yield savings account or whether to deposit them directly into his bank account: the same goes for the deposit account.

Unfortunately, the geographical expansion of Apple’s financial services proceeds much more slowly than the new computers, devices and software, this is also due to the regulations and agreements necessary to operate in the various countries. The most striking example is Apple Card, available since 2019 in the USA, but since then it still remains an overseas exclusive.